new mexico gross receipts tax changes

Taxation and Revenue New Mexico. Taxation and Revenue New.

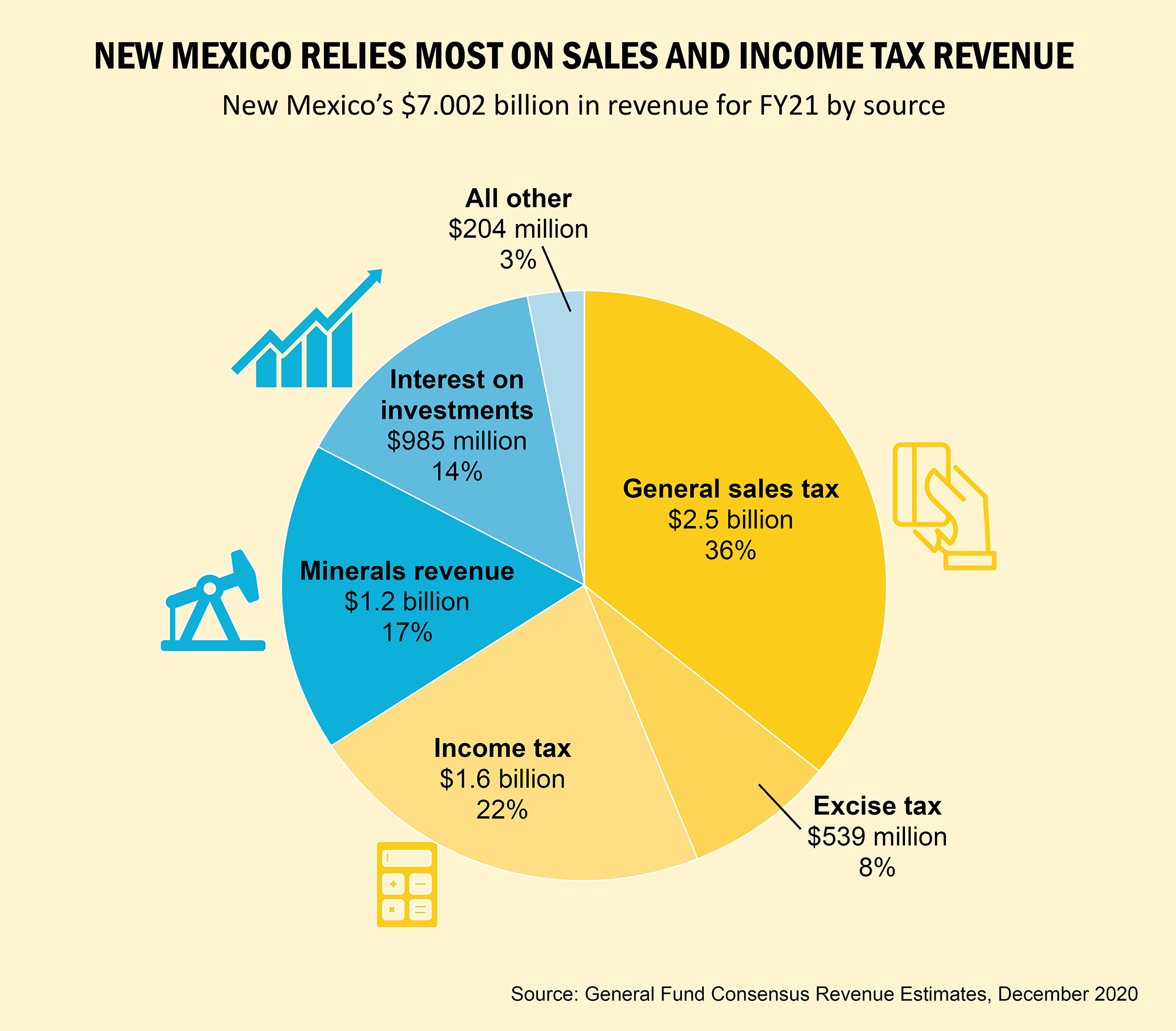

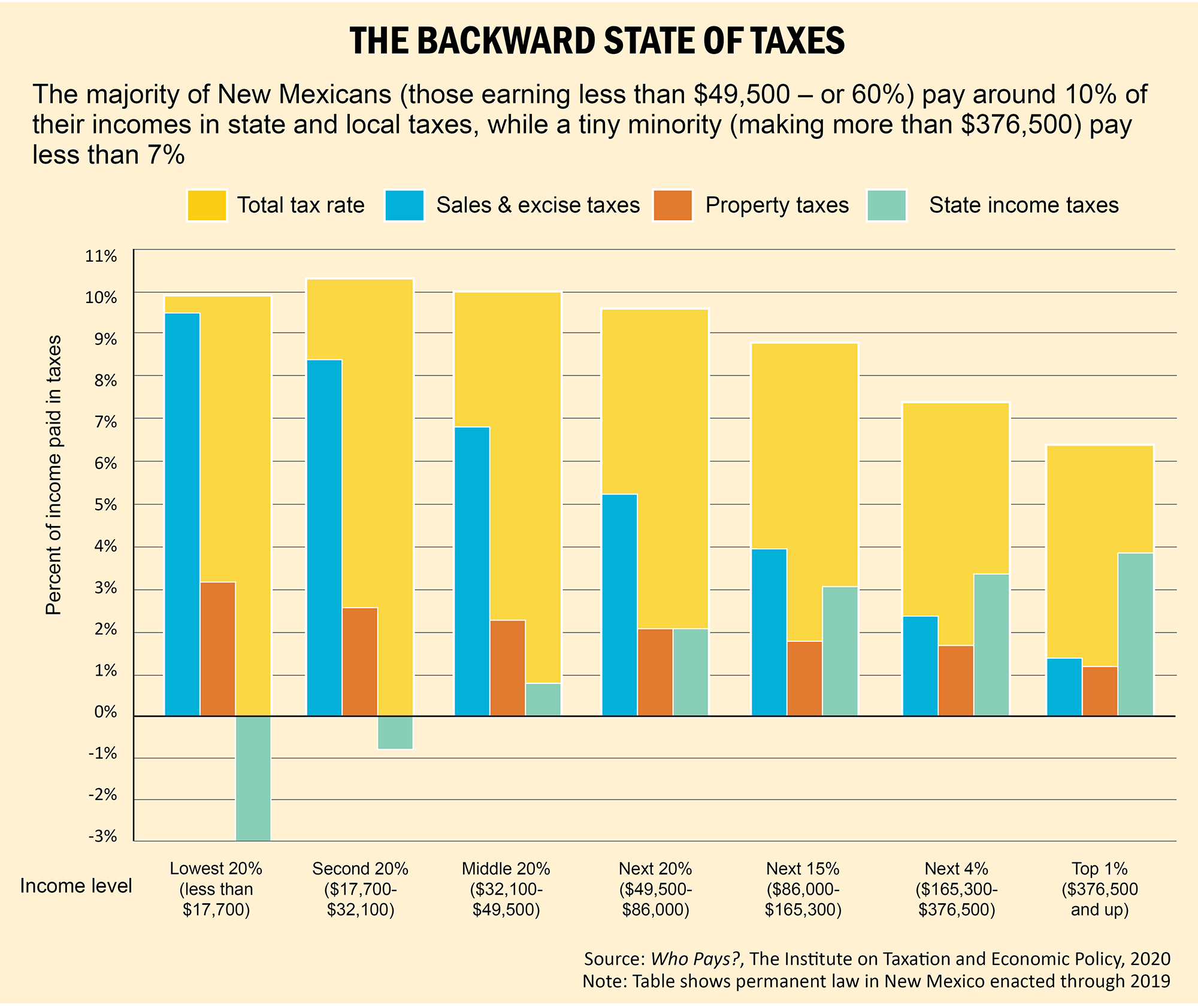

A Guide To New Mexico S Tax System New Mexico Voices For Children

Back-to-School Tax Holiday is this weekend.

. A Nontaxable Transaction Certificate NTTC obtained from the Taxation and Revenue Department TRD allows you as a seller or lessor to deduct the receipts from qualified. Hearing Thursday on new Gross Receipts Tax regulations. Changes Coming to Combined Reporting System.

Taxation and Revenue New Mexico. Legal liability for New Mexico gross receipts tax is placed on sellers and lessors. Fill Print Go.

Property Tax Division. Changes Coming to Combined Reporting System. As a seller or lessor you may charge the gross receipts tax amount to your customer.

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

What You Should Know About Changes To Nm Tax Reporting Youtube

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Nm Gross Receipts Tax Deduction For Food And Beverage

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

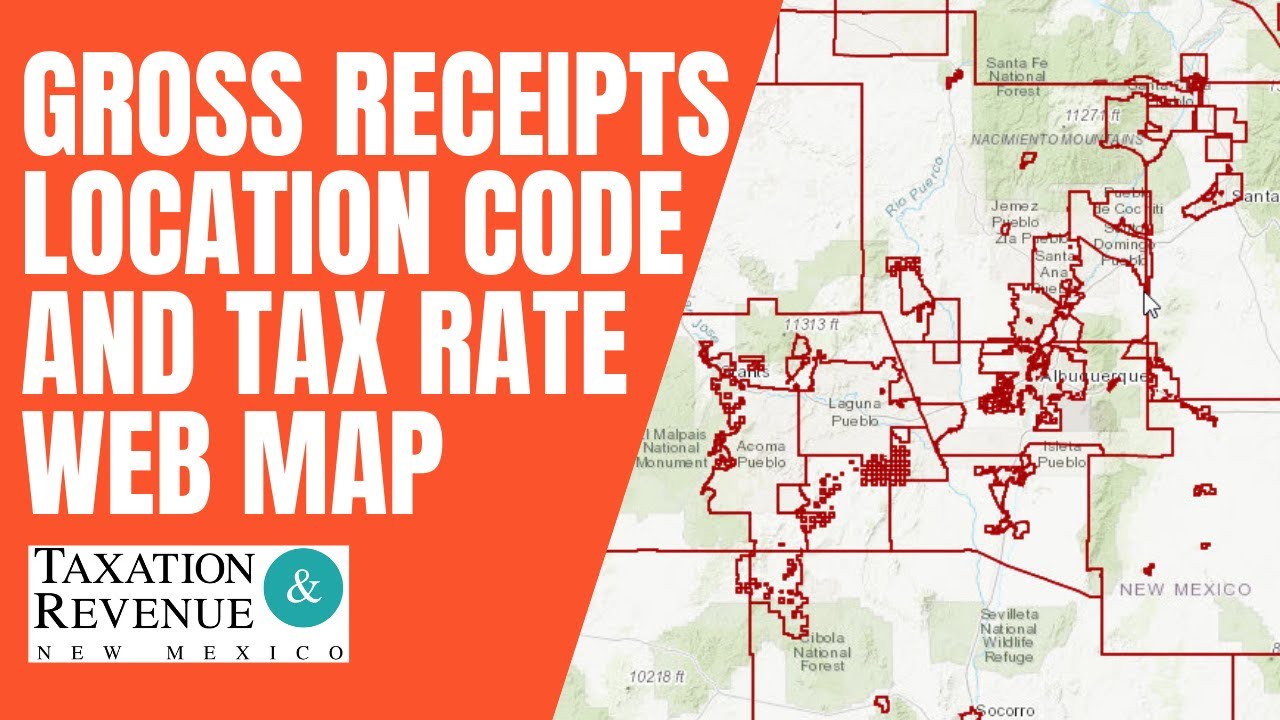

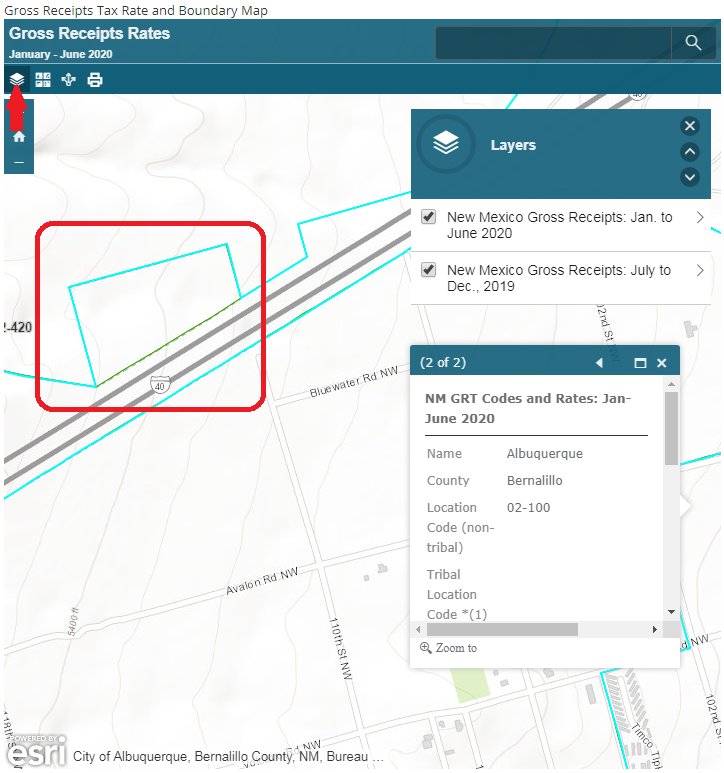

Gross Receipts Location Code And Tax Rate Map Governments

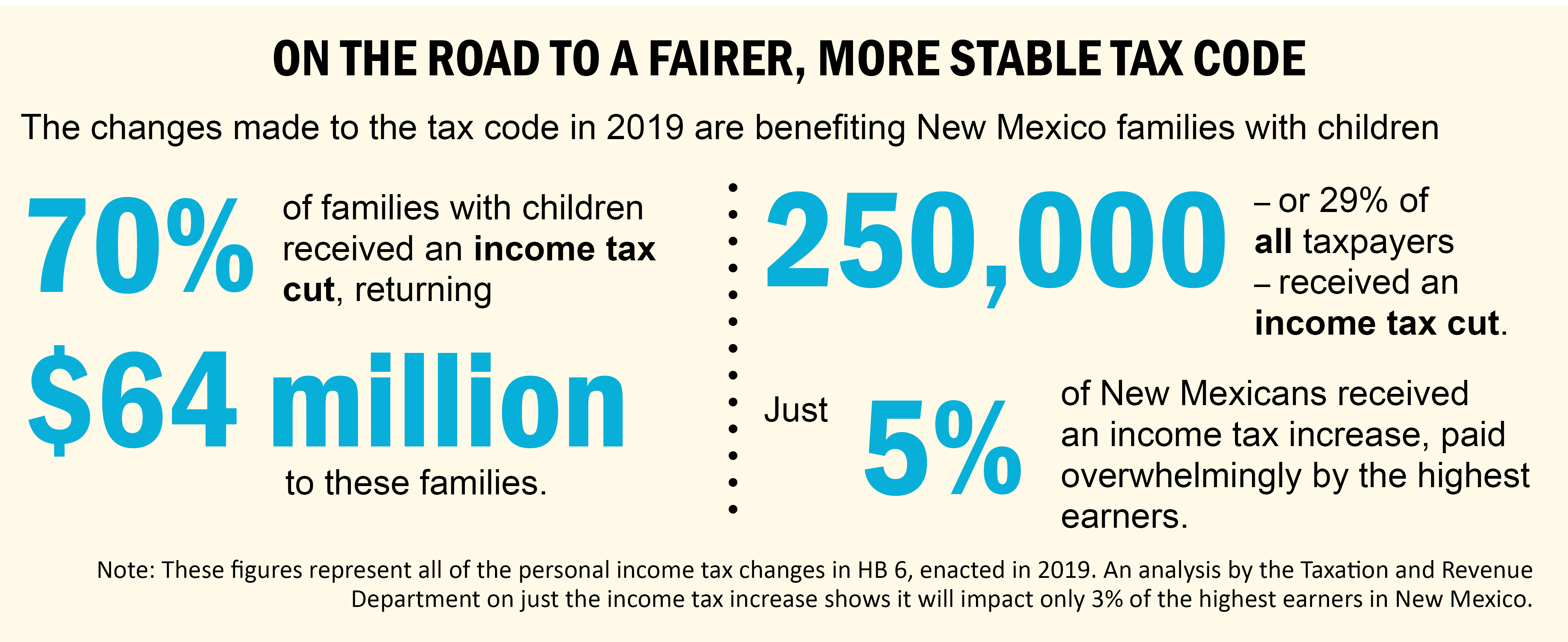

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

2016 Impuestos Como Porcentaje Del Pib 2016 Economic Analysis Gop Tax

New Mexico Tax Law Unintentionally Cuts Into City Revenues Kob Com

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Tax News Views Podcast Gross Receipts Deloitte Us

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

A Guide To New Mexico S Tax System New Mexico Voices For Children

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)